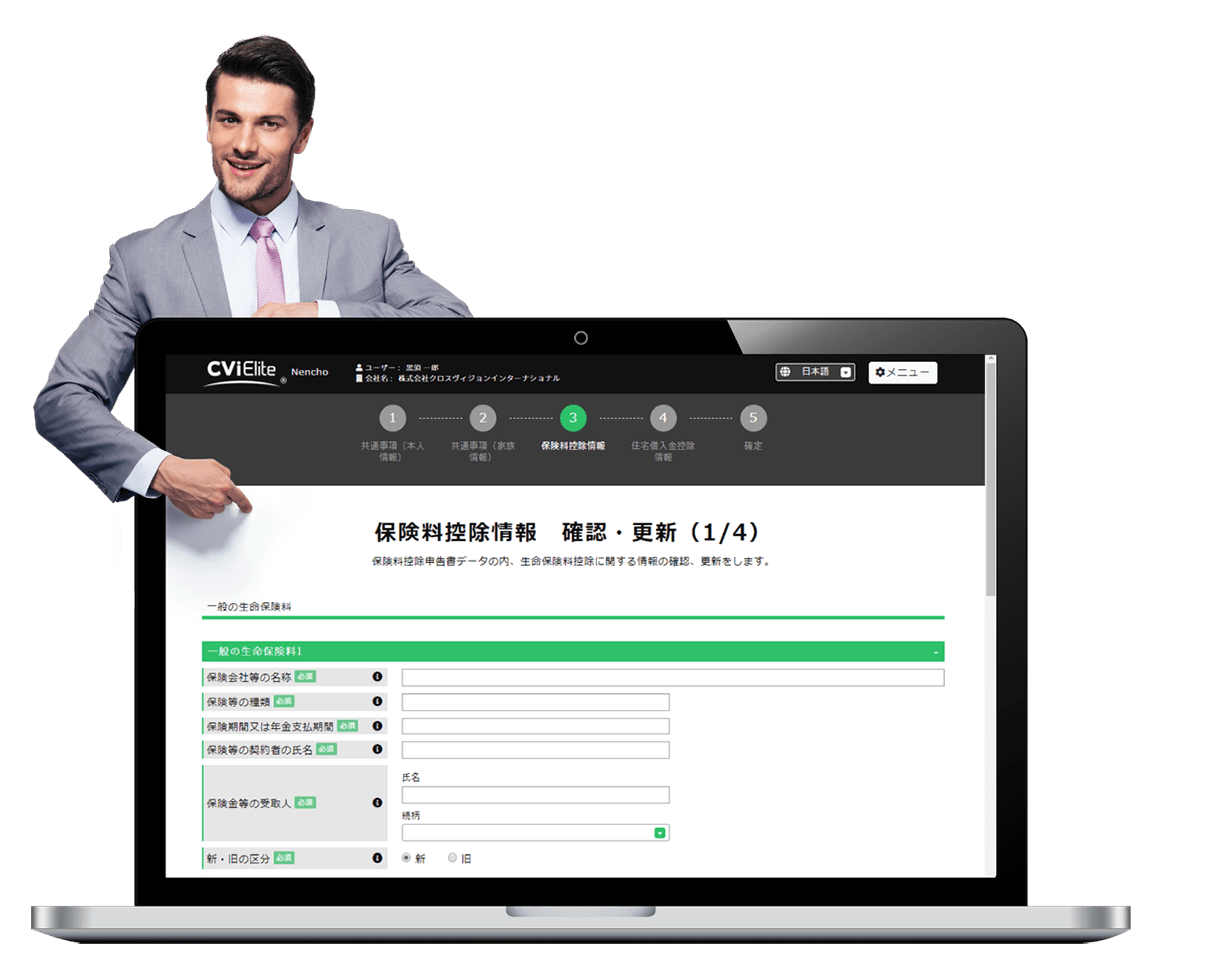

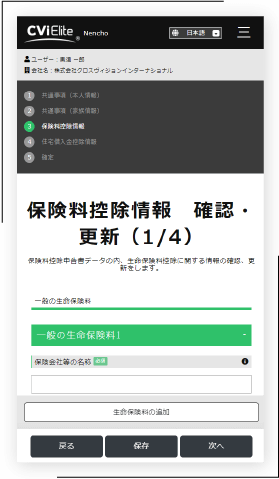

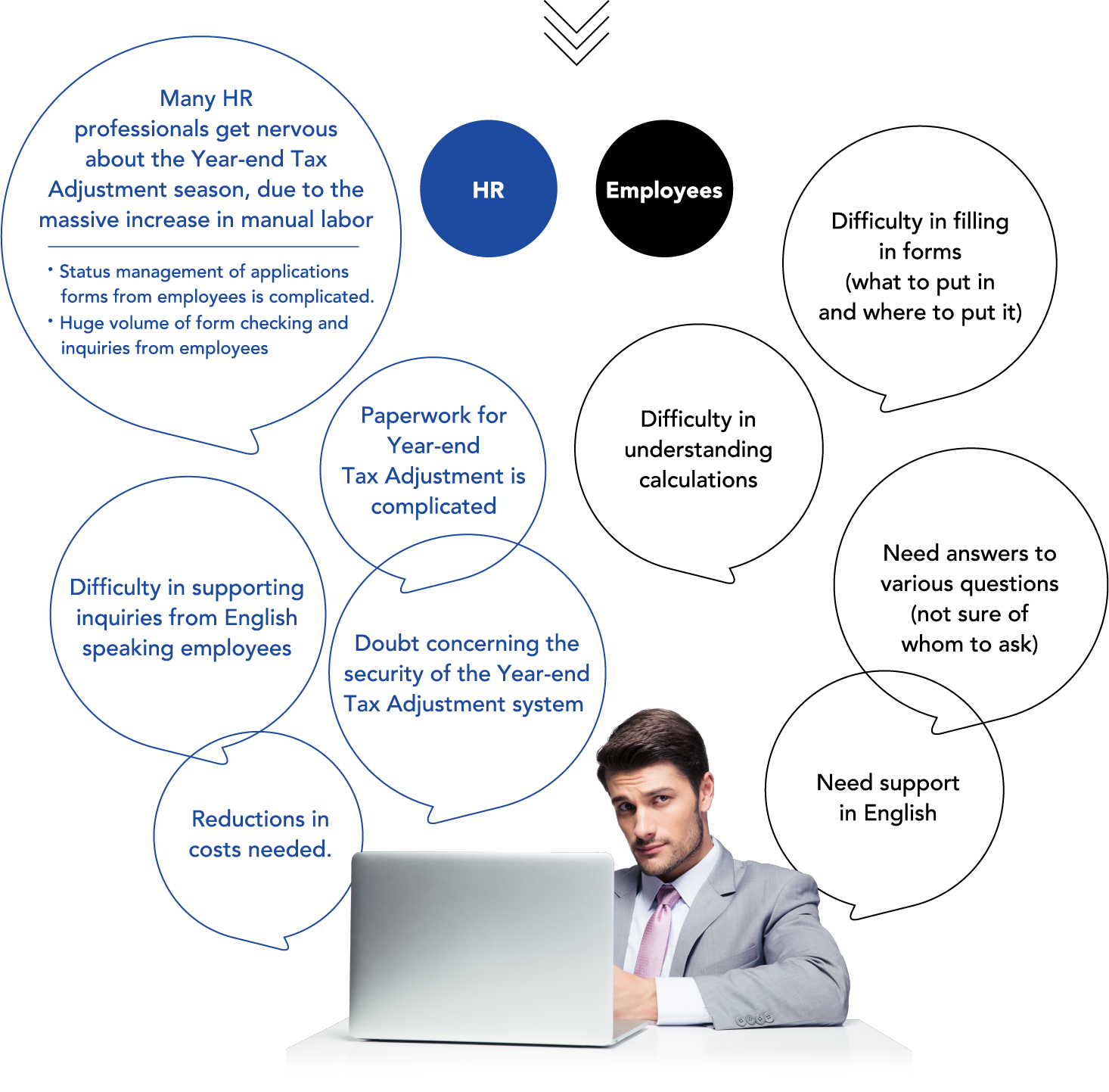

Easy data entry through input from your PC,

smartphone and/or tablet

Reduce time for HR and employees through digital networks

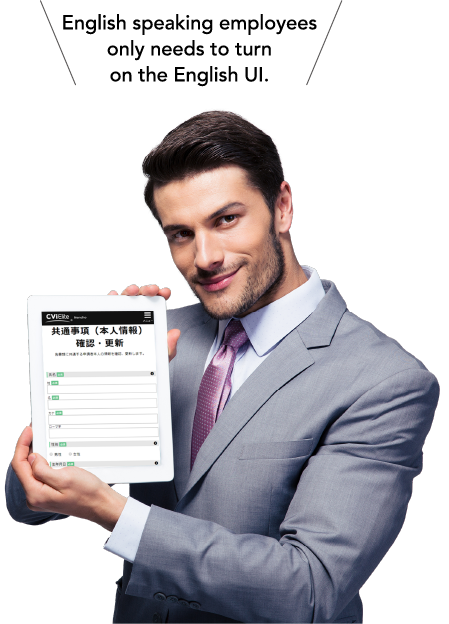

Reduce HR support through a bilingual application

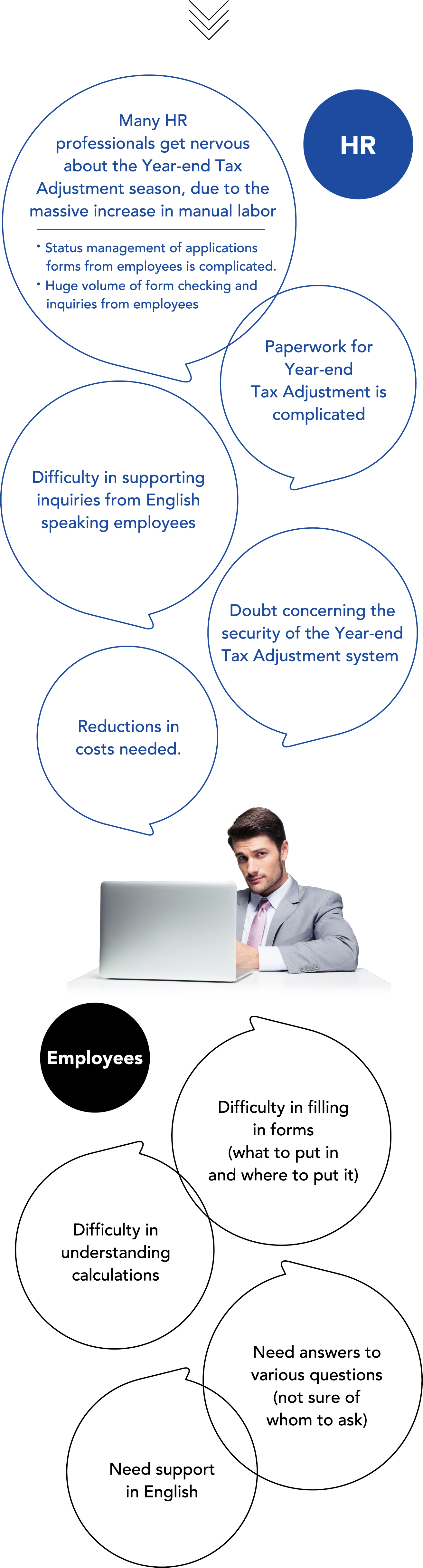

CViElite Nencho is a bilingual Year-end Tax Adjustment application service residing in a high security, private cloud environment. CViElite Nencho offers higher efficiency in processing Year-end Tax Adjustment work through digitization.

Bilingual support

Bilingual information and messages on the user interface (UI) assist in the support of new hires and native English speaking employees who may be unfamiliar with the Japanese Year-end Tax Adjustment process.

PCs, Smartphones,

and Tablets support

With CViElite Nencho, employees can complete their application forms from anywhere, using a PC, smartphone, or tablet.

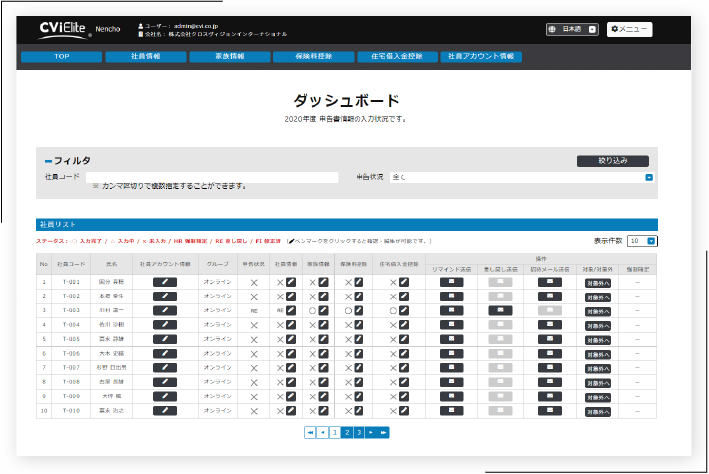

Easier process management

with other CVi applications

CViElite Nencho, together with other CVi applications, offers greater value for HR process management.

Broadcast and

individual messaging

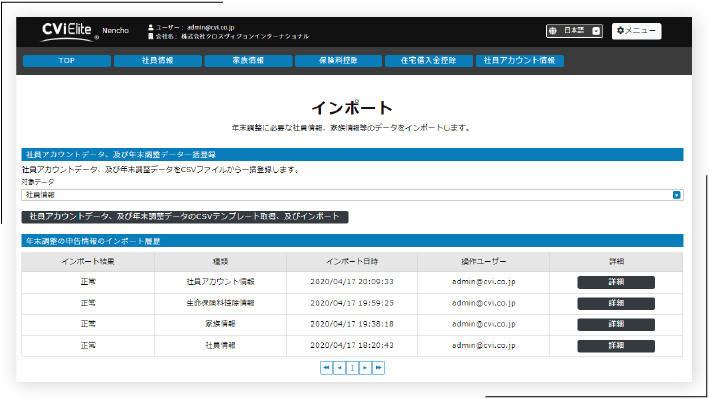

HR personnel can now easily monitor Year-end Tax Adjustment status, by company or individual employees, using an HR dashboard. Moreover, messaging functions support HR personnel in managing the Year-end Tax Adjustment process. And, Year-end Tax Adjustment data can be exported to any payroll system, in “csv” file format.

Easy startup

CViElite Nencho supports any company size, whether small or large.

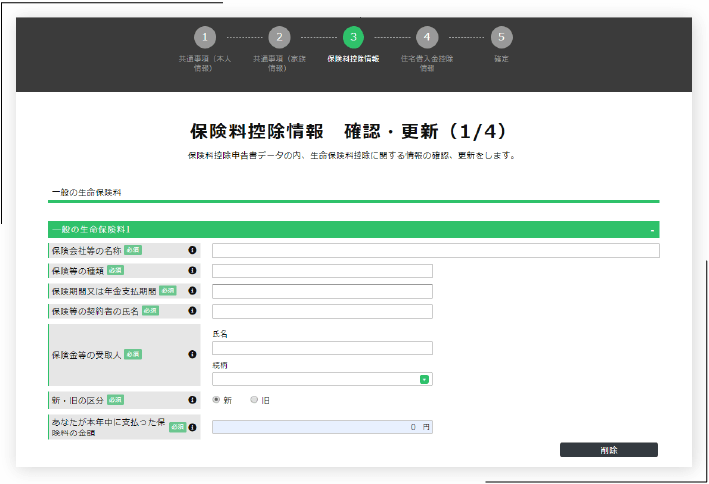

Both HR personnel and employees can use CViElite Nencho to navigate the complete process needed to move forward, without missing a single needed step.

![Merit

[Time savings, greater efficiency through ease of use, and cost effective.]

CViElite Nencho

Major 3 merits

Time saving

Easy Entry

Cost Effective](../assets/img/english/top/merit_ttl_pc.png)

![Merit

[Time savings, greater efficiency through ease of use, and cost effective.]

CViElite Nencho

Major 3 merits

Time saving

Easy Entry

Cost Effective](../assets/img/english/top/merit_ttl_sp.png)

- Huge reduction in time for HR personnel

- Digital application forms significantly reduce the time required for distribution and collection of paper application forms.

Useful suggestions on data entry items, reduces inquiries from employees and the time of important HR personnel.

No need for manual data input through the use of the data

import function

HR operations for data import and so forth are supported through, CViElite Nencho's bilingual support desk.

Easy tracking of employee data entry status through

the HR Dashboard

HR staff can broadcast notes to all employees, or send individual message to employees who are behind schedule.

And, CViElite Nencho supports bilingual messages.

Native English speaking employees can use the English user interface (UI), dramatically reducing inquires to HR.

Deducted amounts are automatically calculated in accordance with employee entries; significantly reducing miscalculations.

- Easy employee data entry.

Application form wizards ensure that employees complete entries

Employees login to the system using an account ID, password and company code. Application wizards inside CViElite Nencho assist employees in navigating the application. And, past data is preset so that employees can double check the data to update.

Easy data entry from smartphones

CViElite Nencho’s bilingual support desk can assist employee data entries (Option: for employees via e-mail).

Employees can easily enter data and confirm their entries by PC, smartphone, or tablet, anywhere and anytime.

A bilingual user interface supports native English speaking employees for easy data entry.

- Increase cost effectiveness

Year-end Tax Adjustment periods,

can be dramatically reduced by eliminating

paper-based applications.

hired to assist in the Year-end

Tax Adjustment processing, can be reduced.

exported to external payroll systems.

Year-end Tax Adjustment service.

They do not include additional services

that may be needed.

Initial fee / Yearly fee

Initial fee (tax exclusive):

to be invoiced after the

application for the service

| Up to 25 employees: | JPY 20,000.- | |

|---|---|---|

| Up to 50 employees: | JPY 30,000.- | |

| Up to 100 employees: | JPY 40,000.- | |

| Up to 250 employees: | JPY 50,000.- | |

| Up to 500 employees: | JPY 70,000.- | |

| More than 501 employees: | ||

Up to 25 employees

(HR and employees):

| Yearly fee (Tax exclusive) |

JPY 15,000.- package fee |

|---|

More than 26 employees

(HR and employees) :

| Yearly fee (Tax exclusive) |

JPY 600.- / staff |

|---|

Bilingual Support Desk service for Employees

(via e-mail)/ Optional (per employee):

| Yearly fee (Tax exclusive) |

JPY 300.- | *Minimum charge is JPY7,500.-. |

|---|---|---|

*Minimum charge is JPY7,500.-. |

- *Please contact our support desk regarding IP address access limitations and SSO.

- *The free trial version can be used without limitation on the number of employees.

- *There are some limitations of functionality on the free trial version.

High security, best industry practices and more.

CVi continuously works on existing security measures whilst improving on changing environments to

maintain customer private information under a secure environment.

High security datacenters

Customer data is stored at high security datacenters. These datacenters have a proven record of providing and enforcing strict security measures, and are the same datacenters used by many financial companies.Encrypted network communications

All in-transit communications are point-to-point encrypted using (SSL256-bit encryption).![]()

The answer is YES!

to all of the questions below

(with the exception of optional services and the Trial Version)

- Is it easy to introduce your system?

- Does the system support entries from PCs, smartphones, or tablets?

- Can I use the system without installing an application on my PC, smartphone, or tablet?

- Can I request support from your Support Desk for questions about usage?

(Optional: bilingual support via e-mail for employees)

News and Updates

- 2021/09/15

- We are pleased to announce new enhanced functionality for CViElite Nencho (Nencho). This new release is being introduced in advance of the 2021 Year-end Tax Adjustment (YETA) operation, and includes the following:

1. The “names of attachments” to be uploaded by linking to the “declaration information,” and required attachments, will be displayed automatically; 2. Eligibility for the “new application form covering housing loan deductions (applicable for those individuals whose residence Start Date was from January 1, 2019, or later); and, 3. Employee operation manuals and Frequently Asked Questions (FAQs) will be included.

Note: 1) Digitization of “deduction certificates will not be supported for 2021; and

2) future enhancements will continue to be added based on customer feedback and requests. - 2020/06/02

- On October 1, 2020, Version 1.1 of CVi’s Year-end Tax Adjustment application will be released with enhanced functionality, such as:

1. PDF file format outputs for application forms;

2. Support of deductions for income amount adjustments;

3. Support for PayrollPro, CVi’s payroll SaaS system;

4. Additional print functions for amount of deduction certificates; and,

5. Picture data upload functions.

Future enhancements will continue to be added to CViElite Nencho, based on customer feedback and requests. Likewise, we will continue to support and enhance our systems accordingly, as the government makes forthcoming announcements and changes. - 2020/06/01

- We are pleased to announce the release of our new, automated year-end tax adjustment (YETA) services, "CViElite Nencho.” The new EN application supersedes paper-based year-end tax adjustment reporting work through the use of PCs, smartphones and/or tablets. Similar to our SaaS applications, EN provides customers with a bilingual service that operates on a high security, private cloud environment.

EN will extensively simplify the data input process, greatly reducing the work time required for year-end tax adjustments, while markedly improving cost-effectiveness.

EN can be used as a standalone system or in conjunction with our payroll system "PayrollPro." Also, data can be linked to other payroll systems, allowing users to use EN to fit your various needs and requirements.

Combined with continuous enhancements for Japanese legislative changes and functional improvements, EN may be the product for you.

30 days free trial

Check out the efficiency of the system by free trial.

The following are some of the reasons regarding how you could make your next YETA more cost effective and easier.

- 1. You can use the same environment with the official service.

You can register and enter company, employee and payroll information. - 2. You can ask questions to our HR support desk

(bilingual support). - 3. Free trial will NOT automatically switch to the official service.

- 4. When you apply for the official service after the trial,

your entered data can be succeeded to the official service.